Bitcoin’s price in the crypto market appears to be on an upward trend as the leading cryptocurrency gained 10% last week, closing at a high of $64,000. This price rally is reportedly linked to the interest-rate cut announced by the Chairman of the US Federal Reserve (Fed), Jerome Powell. Additionally, the rally was supported by a significant inflow of capital into BTC from Bitcoin ETFs.

The net inflow from Bitcoin ETFs was announced by the co-founder of WeRate, a blockchain platform that leverages GameFi and SocialFi to reward people for providing honest and true reviews to businesses. The WeRate co-founder mentioned on his Twitter handle that Bitcoin ETFs injected $700 billion into the Bitcoin market over the past week. While expressing his bullish outlook for the cryptocurrency, he analyzed that ETFs purchased about $500 billion in BTC last week, with an additional $200 billion bought yesterday.

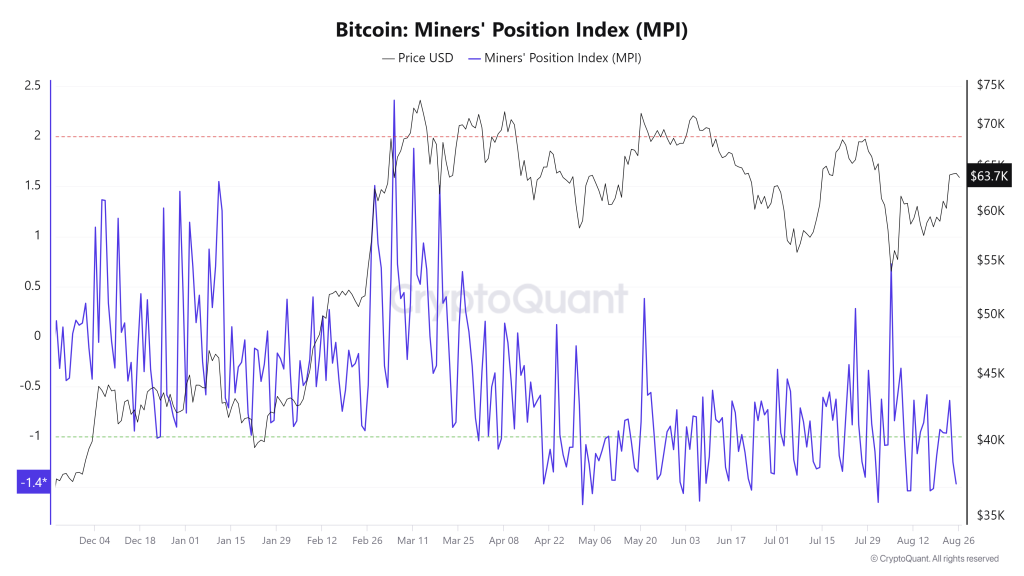

Apart from the substantial cash inflow from ETFs, another bullish indicator for the crypto market is the decrease in the Miners Position Index (MPI), as reported by CryptoQuant. The MPI, which signals a bullish outlook for Bitcoin’s price, represents the ratio of miners’ outflow in USD relative to the moving average of Bitcoin throughout the year.

Bitcoin Sees Immediate Selling Pressure Following Price Rise

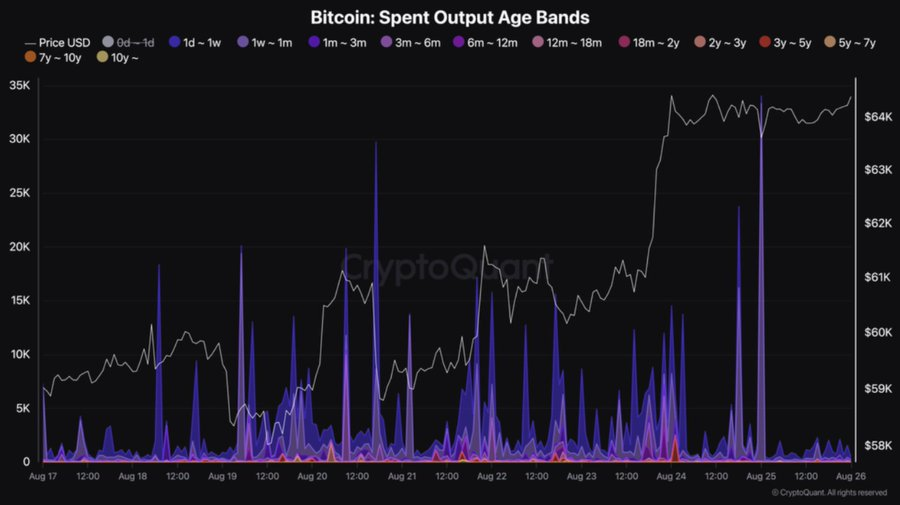

Despite the bullish signals from the ETF cash inflows and the Miners Position Index (MPI), CryptoQuant also reported that Bitcoin might experience a “brief pullback.” This is largely due to the immediate selling pressure the cryptocurrency witnessed from short-term holders who are likely taking profits.

As revealed in the 1w-1m spent output age bands chart by CryptoQuant, “short-term holders transferred 33,155 bitcoins,” indicating significant selling pressure.

Disclaimer

Today's Gazette cannot take responsibility for any form of loss or inconvenience that may result from any material contained on this website. The content is provided for informational purposes only and should not be relied upon for legal or financial decision-making. Nothing on this platform should be misconstrued as financial advice.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.