The world’s first self-custodial Bitcoin staking platform, Babylon, reached its cap just two hours after its mainnet launch. The platform announced that it successfully staked 1,000 BTC within a few hours. Babylon claims it is transforming Bitcoin “into a stakable asset without giving up custody.”

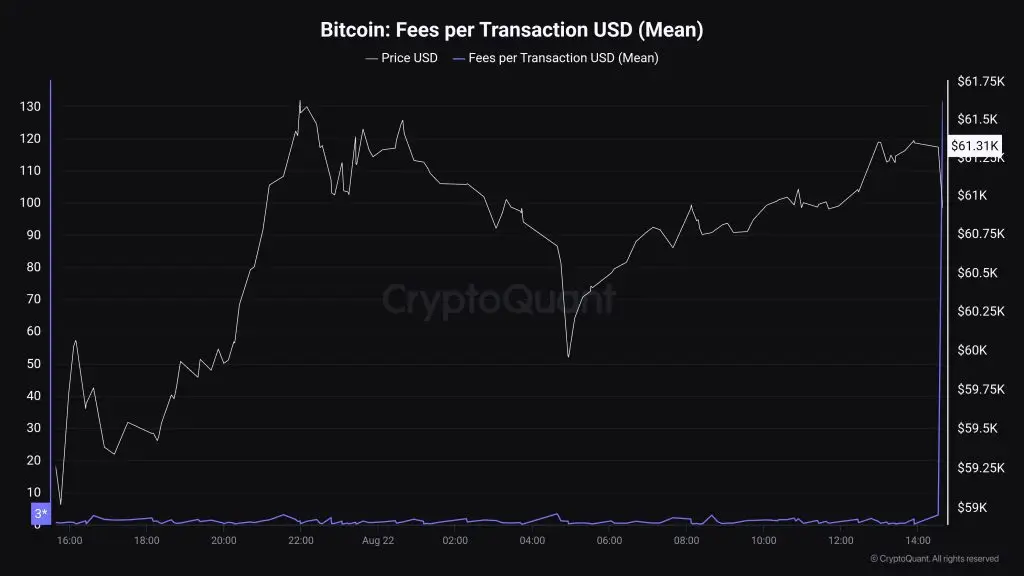

The launch caused a stir in the community, as many rushed to participate in the staking. This sudden demand led to a sharp increase in Bitcoin transaction fees, soaring from $0.50 to $137.

Babylon’s protocol allows users to stake their Bitcoin directly on any PoS system, earning rewards while retaining complete control of their assets. The platform operates without third-party addresses, bridging, or oracles, ensuring that “what happens on Bitcoin, stays on Bitcoin.”

Though still in its early stages, Babylon asserts that its platform is pioneering a third native use case for Bitcoin: staking to secure PoS networks while earning rewards.

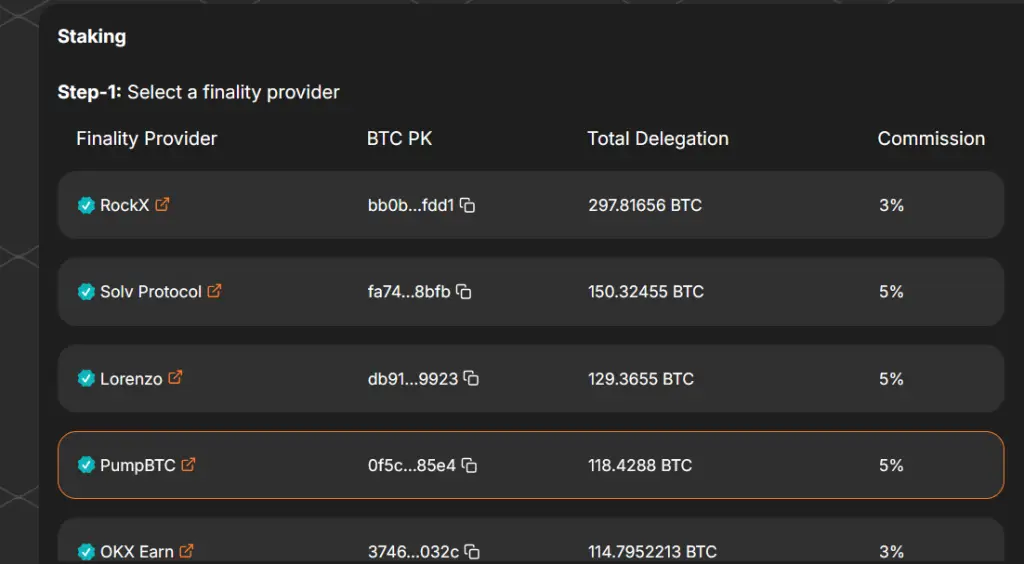

RockX led the staking with 297.81656 BTC, followed by Solv Protocol, Lorenzo and PumpBTC among others.

Also, decentralized Bitcoin reserve, Solv Protocol, anounced its participation in the Babylon Mainnet, staking 250 BTC through the OKX and Solv nodes. Solv Co-founder Ryan Chow who made the disclosure said that users of SolvBTC will share in the profits at no additional cost.

Bitcoin Post-Halving Bull Run Expected to Last Longer and Go Parabolic in Q4

The current Bitcoin rally in the crypto market appears to be deviating from previous cycles, with the price of the leading crypto asset remaining below its pre-halving all-time high. As a result, prominent crypto analysts suggest that this cycle may last longer than any we have seen before.

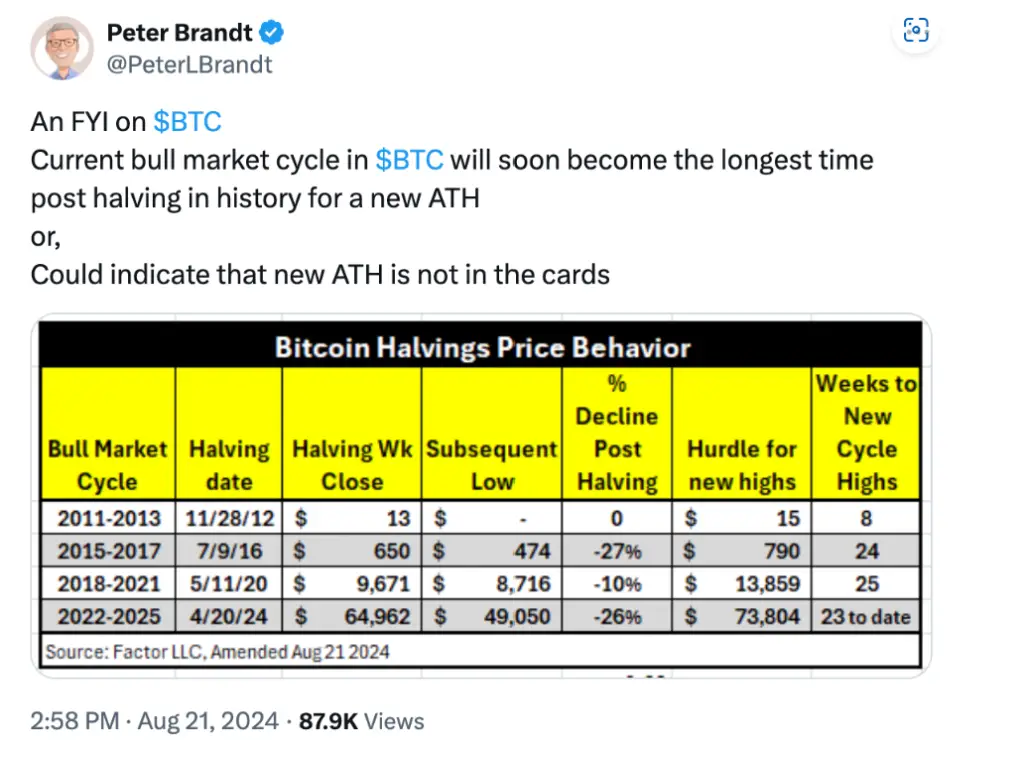

Veteran crypto analyst Peter Brandt mentioned in a tweet that the current bull market cycle could mark the longest post-halving rally before Bitcoin reaches a new all-time high. Brandt, showcasing a table of previous halvings and Bitcoin price cycles, added that this indicates Bitcoin might not attain an all-time high anytime soon.

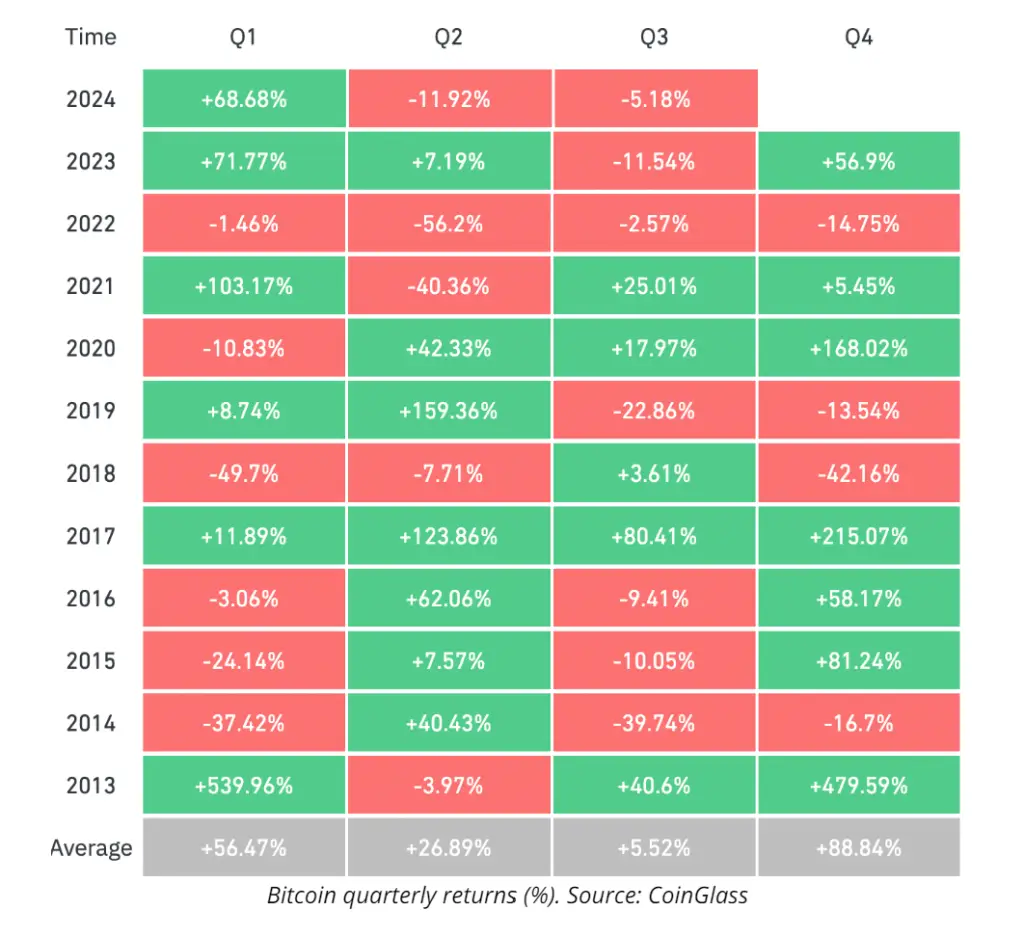

Information from Coinglass, a crypto trading and information platform, reveals that Q4 has historically been a significant period for Bitcoin bull runs. According to the data, Bitcoin has experienced positive gains 7 times out of 11 between 2013 and 2023. Although Q2 has also seen positive gains, that period has already passed.

Therefore, the historical performance of Bitcoin in Q4, coupled with Peter Brandt’s prediction, suggests that Q4 may be the time to watch for a new Bitcoin all-time high.

Disclaimer

Today's Gazette cannot take responsibility for any form of loss or inconvenience that may result from any material contained on this website. The content is provided for informational purposes only and should not be relied upon for legal or financial decision-making. Nothing on this platform should be misconstrued as financial advice.

Your article helped me a lot, is there any more related content? Thanks!